Rising Commodity Prices

Commodity prices rose significantly in 2016 across a variety of commodities, averaging 11% across the Bloomberg commodity index.Charlie Reinhard, MainStay Investments Chief Portfolio Strategist summarized the situation.“Prices have been trending upward across different commodity complexes from energy to metals to foodstuffs. With developed and emerging market economies growing and the supply and demand balance in commodity markets generally improving, we look favorably on commodity-sensitive investments to help diversify balanced portfolios.”

Commodity Price Increases – 2016

Source: Thomson Reuters Datastream, as of 12/30/16. An investment cannot be made directly into an index. Past performance is no guarantee of future results.

Rising Inflation and Interest Rates

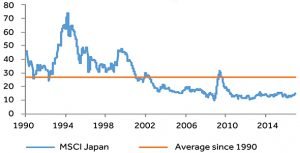

Reduced unemployment and increased government spending are likely to cause inflation and interest rates to rise.Growing corporate profits are likely to be the primary driver in stock market returns, while increased interest rates will work against these returns“We enter 2017 with profit growth as the likely top source of equity returns in the U.S. Fortunately, earnings growth is picking up. Firms with attractive opportunity sets for growth and strong capital discipline on how to allocate free cash flow should be relatively well-positioned. Meanwhile, a more hawkish Fed could pose some headwinds on valuation multiples.”Japanese stocks appear reasonably valued based on historical price-to-earnings ratios

Historical Forward PE of the Japanese Stock Market

Source: Thomson Reuters Datastream, as of 12/26/16. An investment cannot be made directly into an index. Past performance is no guarantee of future results.